Diminishing value depreciation formula accounting

Diminishing value method Another common method of depreciation is the diminishing value method. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

Accumulated Depreciation Definition Formula Calculation

Calculate Diminishing Value Depreciation First Year diminishing value claim calculation.

. Ad Get Complete Accounting Products From QuickBooks. Multiply the rate of depreciation by the beginning book value to determine the expense for that year. Depreciation Accounting Writtendownvaluemethod DiminishingvaluemethodDepreciation Diminishing Value Method Written Down Value Method Solved Problem.

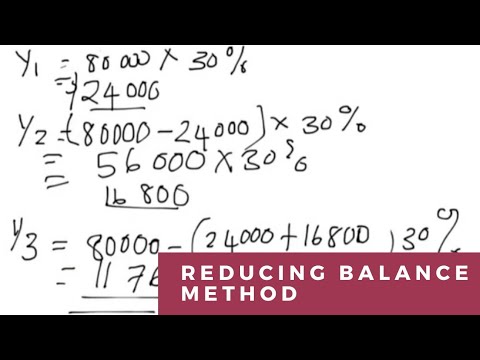

80000 365 365 200 5 32000 For subsequent years the base value. If your claim seems feasible then the next step is to proceed with an appraisal. Depreciation Rate of depreciation x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on.

For example 25000 x 25 6250 depreciation expense. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance. Year 1 2000 x 20 400 Year 2 2000 400 1600 x.

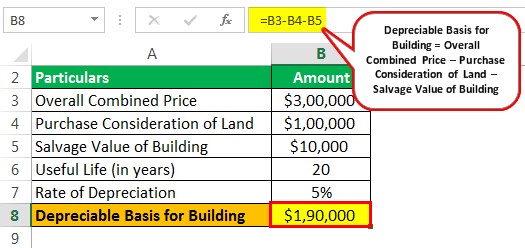

Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its. Get Products For Your Accounting Software Needs. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

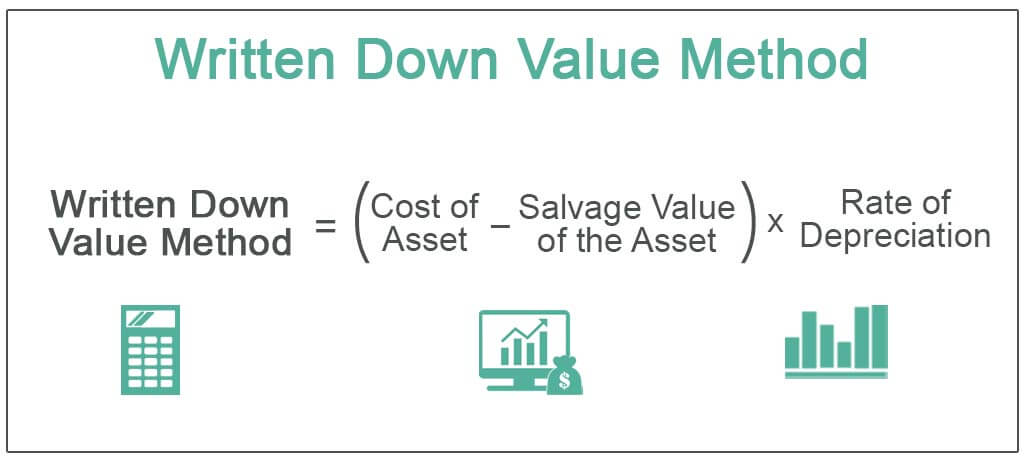

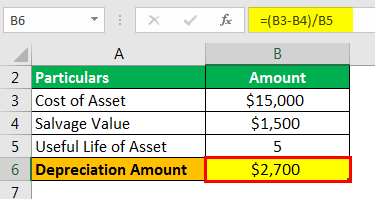

Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is- Depreciation. Ad Get Complete Accounting Products From QuickBooks.

According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset. When using this method assets do not depreciate by an equal. If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is.

For the second year the depreciation charge will be made on the diminished value ie Rs 90000 and it will be 90000 10 R s 9000 Now the value of the. And the residual value is. Diminishing Balance Method Example.

Depreciation Amount for year one 1800. Depreciation Amount for year one 10000 1000 x 20. It is difficult to calculate optimum rate of depreciation But we can use following formula for calculating depreciation in WDV.

The closing value for year one is calculated by subtracting the. Base value days held 365 150 assets effective life Reduction for non-taxable use. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years.

Diminishing balance Method Actual cost of AssetRate of depreciation100 13700020100 Depreciation Amount for 1 st year will be 2740000 Similarly we can. R 1 SC 1n R rate of depreciation S S. Formula Depreciation amount book value rate of depreciation100 Some of the merits of diminishing balance method are as follows Recognised by income tax.

2000 - 500 x 30 percent 450. 80000 365 365 200 5 32000 For subsequent years the base. Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap.

The rate of depreciation is 30 percent. As the book value reduces every year it is also known as the. Get Products For Your Accounting Software Needs.

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Method To Get Straight Line Depreciation Formula Bench Accounting

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Depreciation Calculation

Declining Balance Depreciation Calculator

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Building Definition Examples How To Calculate

Straight Line Vs Reducing Balance Depreciation Youtube

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Calculate Depreciation Expense

Depreciation Basics Accounting For Depreciation Youtube

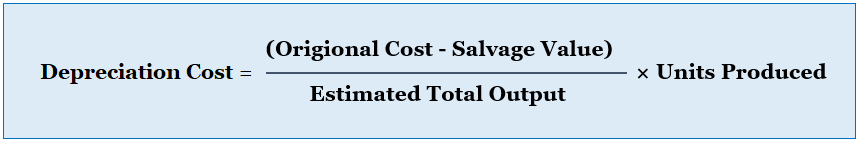

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub